Westminster Council’s financial situation involves balancing rising service demands (like homelessness support, social care) with reduced government grants, leading to budget gaps, but they also benefit from strong local revenue, allowing for relatively low council tax hikes (around 46p/week for Band D in 2024/25) and strategic investments through “Fairer Westminster” initiatives. Recent funding changes from the government, shifting funds to deprived areas, pose significant risks, potentially requiring higher council tax increases (even over 5% without a vote) and emergency funding, despite Westminster’s strong economic base from tourism and business rates.

All this whilst, the Institute of Fiscal Studies figures being quoted by the main stream media, of an 75 per cent increase in Council Tax as a result of government grant reductions to several London boroughs need to be explained by them more fully. As they don’t actually give us actual examples of the Council Tax going up amongst properties in the City of Westminster.

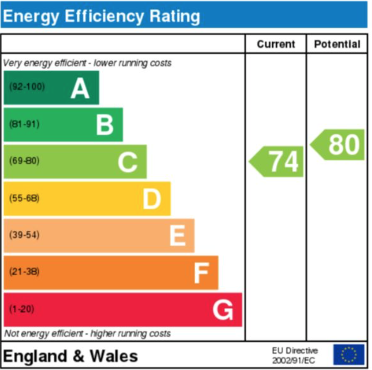

The key aspects of Westminster’s finances involving the Council Tax, is they aim to keep Band D tax low, increasing it modestly (e.g., 46p/week in 2024/25) to fund vital services, benefiting from commercial revenue. Though there are budget pressures with significant costs arise from temporary accommodation for homelessness, adult social care, and inflation.

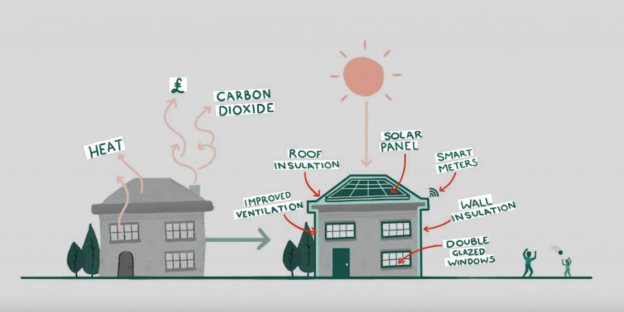

Furthermore, the funding changes with recent government decisions shift funding from boroughs like Westminster and potentially forcing higher council tax rises or use of reserves. The Labour administrations “Fairer Westminster” Investments see the council invests in community support, CCTV, and care worker pay since 2022 and continued apace since. Their medium-term outlook, forecast budget gaps (e.g., £19.6m for 2026/27), but also plan for multi-billion pound capital programs and manage significant financial risks.

With recent developments of late 2025, the Government Funding Review involves a new funding model shifting resources, impacting London boroughs like Westminster, who are expected to lose funds. The one concession given is that the Council Tax Cap Lifted do as the government allowing some councils, including Westminster, to raise council tax by over 5% without a referendum for two years, due to the dramatic funding changes. The financial risks, faces now is in Westminster City Council faces a potential for large budget shortfalls (e.g., £68m by 2028/29) despite strong local income.

They must fight for a big slice of the Tourist Tax from the Mayor and lobby to get ring fenced funds like parking income to be used in the general fund and sell off any key assets in the West End like car parks for sure over the next few years to keep council taxes in the city low in comparison to the rest of London, as its residents are grown accustom too.

All the figures for the council can be found on Westminster City Council Website, searching for “Cabinet reports,” “Medium Term Financial Plan,” and “Statement of Accounts” for detailed documents.