As today is the long anticipated Budget Day to be undertaken by Rachel Reeves, Chancellor of the Exchequer, we are entitled to ask what is the impact of VAT on refurbishment and retrofit works and what is the Budget is likely to include based on recent speculation and government direction?

VAT Impact on UK Refurbishment & Retrofit Today

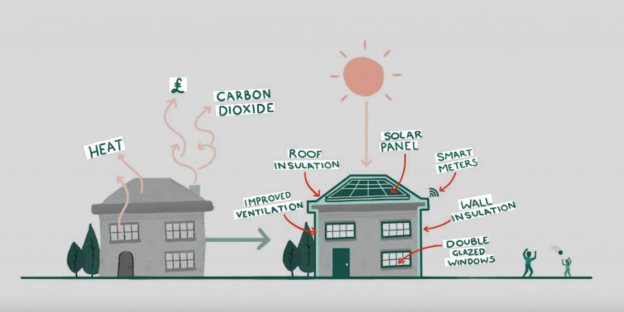

The Problem is the standard VAT rate on most repair, maintenance, and general renovation work remains at 20%. This is the core issue that industry groups (like the Federation of Master Builders) have campaigned against for years, as it creates an incentive to demolish and rebuild (which is zero-rated) rather than to retrofit. The 20% VAT is still a barrier clearly.

Energy-Saving Materials (ESMs): Zero-Rated (0% VAT)

The installation of most Energy-Saving Materials (ESMs)—including insulation, heat pumps, and solar panels—is currently zero-rated (0% VAT). The current status of this relief was put in place until March 31, 2027, and directly benefits energy-efficiency retrofitting. It covers both the labour and the materials when installed by a contractor.

Rachel Reeves’ Budget: Signs on VAT and Retrofit

There are strong indications that Chancellor Rachel Reeves is focusing her Budget not on a broad VAT cut for all refurbishment, but on targeted financial support and adjustments to energy pricing mechanisms to reduce bills and promote retrofitting.

Key signs & speculation of the focus will be on subsidies over broad VAT cuts. The government has repeatedly stressed fiscal responsibility. A blanket cut to 5% VAT on all general renovation (dropping the 20% rate) would be a massive, expensive change that could be seen as breaking the party’s manifesto pledge not to raise the main rates of VAT (though a cut wouldn’t break the pledge, it costs revenue).

The government’s core strategy for greening homes, the Warm Homes Plan, has been focused on direct funding and subsidy schemes (like the Boiler Upgrade Scheme and insulation grants), which can be precisely targeted towards low-income and fuel-poor households.

There is strong speculation that the Chancellor is looking at measures to move environmental levies (like those funding clean energy and some efficiency schemes) off household electricity bills and into general taxation.

This would immediately make electricity cheaper relative to gas, making the running costs of heat pumps (a key retrofit technology) much more attractive and helping to drive the transition away from gas boilers. This is viewed by some as a more effective, structural way to encourage electrification than a broad VAT cut.

At the same time targeted adjustments to Existing Schemes. Reports suggest the Chancellor may be restricting eligibility for certain subsidies, such as the Boiler Upgrade Scheme (for heat pumps), so that they are more focused on households receiving benefits or with lower incomes, in a move to make the funds stretch further and target those in greatest need.

Conclusion on VAT for Refurbishment

While many industry experts (and the construction sector) continue to lobby the Chancellor to scrap the 20% VAT on all labour for refurbishment to genuinely “level the playing field” with new builds and meet climate targets, the current focus is on:

-

Maintaining the 0% VAT on specific energy-saving materials (like heat pumps and insulation).

-

Using direct grants/subsidies for deep retrofitting.

-

Making structural reforms to electricity pricing to encourage the switch to low-carbon heating.